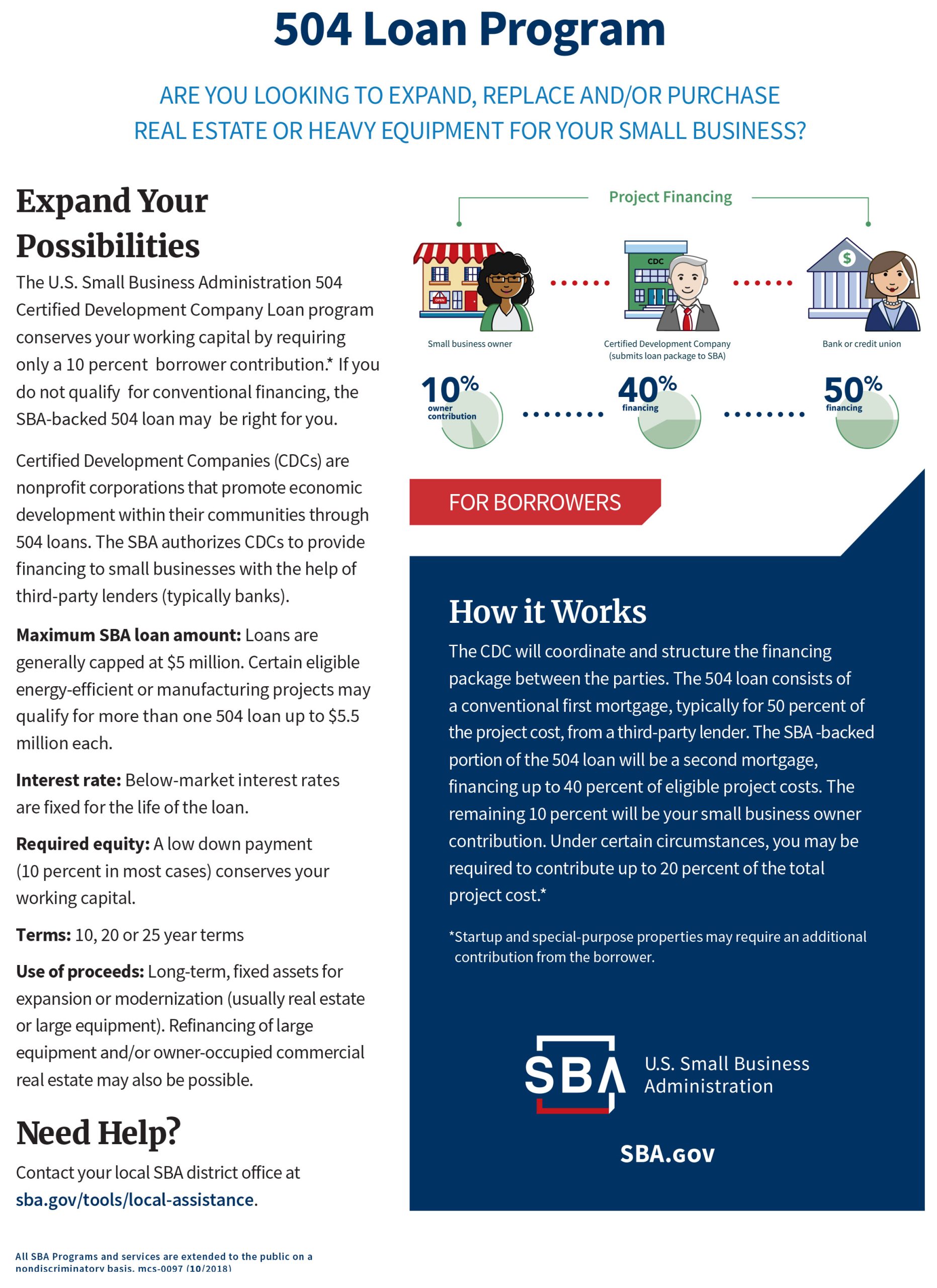

An SBA 504 loan, sometimes called The CDC/504 Loan Program is a US government guaranteed loan that provides long-term, fixed rate financing for major fixed assets that promote business growth and job creation. SBA 504 loans are available through Certified Development Companies (CDCs), SBA’s community-based partners who regulate nonprofits and promote economic development within their communities. CDCs are certified and regulated by the SBA. Eligible loan purpose: Purchase of major fixed assets like land, buildings, equipment, and machinery Loan amount: Up to $5 million on CDC portion, up to $5.5 million for specific businesses Interest rates: Fixed, typically about 5% to 6% for CDC 2nd; bank rates for 1st can vary Terms: Up to 25 years Down payment: 10% of the loan amount Collateral: Project assets being financed are often used as collateral; personal guarantees for business owners of 20% or more are required The borrower will pay 10% of the loan as a down payment. The CDC will put up 40% of the loan’s value. An SBA-approved lender will then supply the remaining 50% of the value. Loan Amount: $1,000,000 Borrower provides $100,000 as a down payment Your CDC supplies $400,000 – This is provided through a second lien, usually with a 20 or 25-year, fixed interest rate. The bank/lender supplies $500,000 – This is a first lien from a private sector bank/lender. A 504 loan can be used for a range of assets that promote business growth and job creation. These include the purchase or construction of: Working capital or inventory Consolidating, repaying or refinancing debt Speculation or investment in rental real estateWhat is the SBA 504 loan program?

SBA 504 Loan Structure

Example:

What can SBA 504 funds be used for?

A 504 loan cannot be used for:

Am I eligible?

Required SBA Forms

Free Live Session on All Over US

Free Live Session on All Over US

Support 425-358-3055

Support 425-358-3055 Register / Login

Register / Login